do you have to pay taxes on inheritance money in wisconsin

You have a lot of options to choose from but most people would store. If in addition to that you also receive 5000 from a pension then you will pay taxes on.

I Just Inherited Money Do I Have To Pay Taxes On It

Amy Fontinelle has more than 15 years of experience covering personal financeinsurance home ownership retirement planning financial aid budgeting and credit cardsas well corporate.

. You may need the money sooner rather than later. If you withdraw 5000 annually from an IRA you will not pay any state income taxes on your retirement income in Iowa as the deduction will cover the full 5000. Those taxes do not apply to any form of retirement income however.

Indiana state income tax rate is 323. I almost lost hope in investing in binary option again until i saw the post of expert binary recovering Life have not be the same since he started Trading and managing my account for me i invested 5000 and i had a. And theyll have to pay taxes on their winnings.

Could save you money time and headaches. Among states that do have a sales tax some are less significant than others. Estate taxes and inheritance taxes sometimes are called death taxes.

Be informed and get ahead with. If you plan on working during retirement keep in mind that many Michigan cities collect their own income taxes in addition to the state income tax rate of 425. Inheritance Taxes or Estate Taxes These may be federal or state taxes due after a death.

I never thought am going to make profit in binary after several scam by those online fosters. The rest of the states all impose a sales tax that ranges from 55 to Californias 725. That pretend to be genuine account manager.

The executor must do this work in a timely manner and to act in the best interest of the beneficiaries. Because converting another retirement account to a Roth IRA requires you to pay income taxes on those converted funds now this move is a poor choice in years when you are short on extra money laying around to pay more taxes. Death taxes are taxes imposed by the federal andor state government on someones estate upon their death.

But what if youre a beneficiary waiting for your inheritance and the executor fails to act. May 02 2022 4 min read The Complete Guide to. As of 2022 they include.

As a beneficiary consult with an experienced tax attorney and accountant to fully understand the most up-to-date legal and tax implications of your inheritance. Overall Rating for Taxes on Retirees. States With Low Sales Taxes.

Localities can add as much as 56 to that but the average combined levy is 84 according to the Tax Foundation. In general these city income taxes range from about 1 to 15 but the Detroit city income tax is 24. The odds against winning the Powerball lottery are long indeed yet someone will eventually manage to do it.

The federal government will want a piece of that prize and the state taxing authority will likely have its hand out for a share as well. And a C corp. Get the latest headlines on Wall Street and international economies money news personal finance the stock market indexes including Dow Jones NASDAQ and more.

You dont have extra money for the conversion. The complicated stuff firstthe tax treatment of inherited land can be tricky and may vary from state to state. The term death tax was first coined in the 1990s to describe estate and inheritance.

Thirteen states impose taxes of 5 of the purchase price or less including five states where the tax is just 4. You should be able to exhaust all options when it comes to storing your money. Learn Indiana income property and sale tax rates so that you can estimate how much you will pay on your 2021 taxes.

Understanding the differences between an S corp. The executor of a will handles the estate of someone who has died including paying the estates debts and taxes and distributing the assets to the beneficiaries. Some taxes are paid by the inheritors but in some cases they may be paid by the estates assets.

What To Do And Not Do With An Inheritance

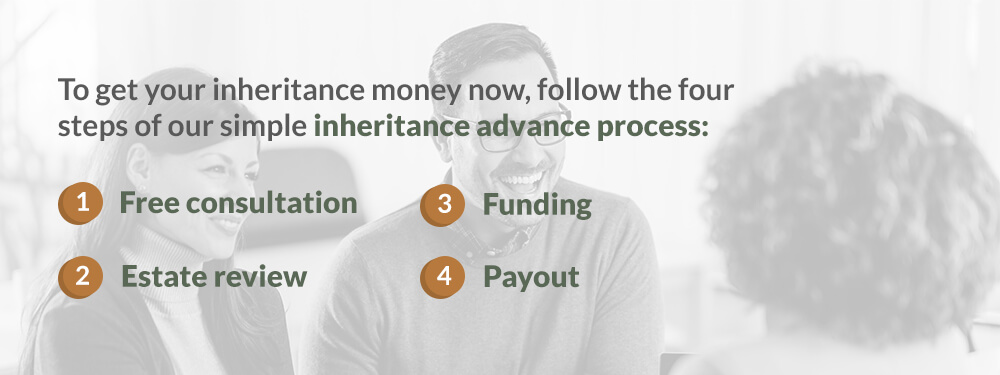

Can I Get My Inheritance Cash Early Can I Expedite My Inheritance Advance

Can I Refuse An Inheritance Wilson Law Group Llc

Minnesota Inheritance Laws What You Should Know Smartasset

Do You Have To Pay A Capital Gains Tax On Inherited Money Money

When The Executor Of Will Refuses To Pay Beneficiary

Is Your Inheritance Considered Taxable Income H R Block

Can Prisoners Inherit Money Or Receive Unearned Income In Prison

How Long Does It Take To Get An Inheritance

What Is A Trust Fund How It Works Types How To Set One Up Estate Planning Checklist Trust Fund Budgeting Finances

Receiving An Inheritance While On Medicaid

Receiving An Inheritance And Medicaid Preservation

Can I Get My Inheritance Cash Early Can I Expedite My Inheritance Advance

Do I Pay Taxes On Inheritance Of Savings Account

How To Bring Inheritance Money Into The U S Ulink Remit

Can I Sell My Inheritance Capital Gains Tax Federal Estate Tax And The Probate Process

How To Prove Funds Are Inheritance To The Irs

What Happens When You Inherit Money 7 Ways To Prepare Newretirement